01 Dec Capital with a Conscience

I know that it is not unique to me, but it seems the older I get the faster time goes. It feels like yesterday that we were discussing 2014 goals and objectives. After celebrating Thanksgiving with family and friends I realize how grateful I am for all the wonderful people in my life. During the holiday season I frequently reflect on what matters most to me. Therefore, I thought it would be interesting to see how investors are investing in what matters most to them.

The idea of investing in companies and strategies that reflect your beliefs and causes that are meaningful to you is not a new concept. This niche form of investing is typically classified as socially responsible investing or SRI. Socially responsible investing is defined as any investment strategy which seeks to consider both financial return and social change for the better. You may have also heard of it referred to as “community investing,” “ethical investing,” “green investing,” or “impact investing,” nevertheless, it all falls under SRI.

Three strategies to SRI include the use of ESG factors (environmental impact, social impact, and corporate governance) when determining investments, community investing, and shareholder resolutions. ESG factors relate to exactly what it stands for. This typically removes investments that contain certain sectors such as tobacco, alcohol, gambling, nuclear power and fossil fuels while maintaining investments that include sectors such as renewable energy, clean water, organic food, green buildings, or companies that employ best practices in terms of environmental, social, and corporate governance (ESG).This strategy focuses on investments that impact the environment such as technology that reduces emissions, social impact investments that improve the well-being of society, and corporate governance where investors invest in companies that have strong corporate social responsibility policies.

Community investing is investing in low income, underprivileged and economically depressed communities to improve the quality of life. This could potentially include infrastructure projects and needed services such as affordable housing and child care. Economic and social development is the main focus for this strategy and overlaps with ESG factors. Community investment finances the creation of resources and opportunities within a community. Ways to invest can be obtained by Community development loan funds, mutual funds, or even banking at a community development bank or credit union.

The third strategy involves shareholder resolutions. Owning shares in a public company gives investors a way to raise environmental, social and corporate governance issues of concern. By filing shareholder resolutions, active shareholders bring important issues to the attention of company management. This presents the opportunity that the resolution could precede to a vote by all shareholders in the company. This could lead to actionable change within the company, media attention, or educating the public on the matter. In some cases this can be just as effective than coming to a vote.

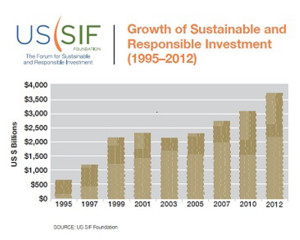

SRI is gaining traction. In 1995 there were just 55 SRI mutual funds with approximately 12 billion in assets. Looking at the chart below, today there are approximately $4 trillion dollars in SRI strategies. This growth has caught the eyes of some of the biggest asset managers and institutions. You can now find SRI options in 401(k)s and other retirement platforms. But who is leading the charge? If you recall from last month’s Maclendon Monthly we wrote about the generational differences of investors. One generation we focused on was the millennials and how they are the largest demographic the U.S has ever seen. Millennials are expected to inherit an expected $15 trillion of baby boomer wealth. With that they are also leading the way in SRI. US Trusts’ Insights on Wealth and Worth 2014 reported that 63% of Millennials have invested or are interested in investing in socially responsible investments compared with 40% of Generation X. This is a stark contrast to previous generations where the only objective was to make money. The progressive mindset of younger generations sheds light on the changes of investment strategies to “meaningful” value.

Alongside SRI is also the rise of Social Investment Entrepreneurs (SIE). SIE represent a growing type of entrepreneur with the intention of creating positive change through the placement of innovative solutions or finances. These entrepreneurs have increased efforts to overcome the challenges of the traditional donation-based philanthropy model through social investment opportunities. They are changing the face of SRI and how their projects are getting funded. Since most SIE operate as a non-profit they cannot offer an ownership stake in exchange for capital, like a traditional business. This lack of an effective funding model has led Social Investment Funds, Angel Investors, Venture Capitalists, and other organizations to channel capital and hopefully revolutionize the way social entrepreneurs obtain capital.

As time goes on we expect SRI to continue to grow. Investments that have meaningful impact not only economically, but socially will continue to resonate with millennials and future generations. Peter Lynch, the portfolio manager who ran the respected Magellan Fund at Fidelity that averaged 29.2% a year once said to “buy what you know,” maybe the next generation will “buy what they believe in.”

At Maclendon we have the flexibility and ability to customize portfolios to offer these investments to our members. We see social investing as an area of opportunity in wealth management that the industry should prepare for as investors look to invest in projects they are passionate about.