27 Oct Fee-fi-fo-FIEFdom

Let’s say you are in the market for a car and after all your research and thinking you conclude you want a Jeep. But you aren’t going to go out and buy that Jeep today, you are going to wait three months to make the big purchase. Over that next three months, with the excitement of buying this awesome new Jeep… what car do you think you will see everywhere you go? The Jeep. You will see one parked next to you at the mall, Jeep commercials are on all the time and one of your colleagues may even pull up in a new Jeep. Why does this happen? Jeeps were everywhere before, but why are they so prevalent now?

Expand Your Fiefdom

Well, you let that car enter your fiefdom. Your fiefdom is your comfort zone, it’s your little cocoon of a world. In it there is routine, comfort, the things you love most in the world. Or should I say YOUR world. You see there are so many aspects outside your fiefdom you are not even aware of. Family time, world travel, and live music are big aspects of my life but might not even be a blip in yours. And because I am not a car person, I won’t even notice the Jeep that has become such an ever-present thing in your life.

One thing that is in my fiefdom and yours is money. What we do with it, how we spend it, how much we need may be different but we both depend on it in one way or another. And there is no giant beanstalk we can climb to infuse money back into our fiefdoms. So when the markets are experiencing volatility and the talking heads are chattering away – the sensationalism of the markets penetrate both of our worlds. People that would not normally think about the markets are bringing them up at the water cooler, dinner conversations turn to the market pull back and you find yourself tuning more frequently into CNBC. But why? If you are a long term investor and have a meaningful plan to reach your goals, the daily headlines should not matter. Yes, we want to be informed and stay relevant in conversations, but being informed and letting the headlines affect your day to day behavior are very different. These knee-jerk, emotionally driven actions can be detrimental to your overall strategy.

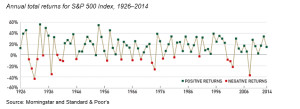

Of course people are concerned about the markets. All these headlines are important in your fiefdom. If the markets are down this can have a huge impact on your life. Will you be able to retire? How much does this set you back? How does this affect your plan? But, you have to maintain perspective and know your time horizon. Although 2015 continues to be challenging and we are currently in negative territory, prolonged periods of negative returns are rare. In the past 89 years, the number of periods when one negative year is followed by another one (or more) only happened 4 times: 1929–32, 1939–41, 1973–74, and 2000–02. Therefore, history suggests if the market finishes negative in 2015, there is a likely chance to rebound in 2016.

What is important to understand is market timing is much less important than pure time. Markets swing. Sometimes you will invest on an upswing and other times on a down swing. You will be on the wrong side of the trade at some point and then what? What is much more important is understanding your personal time horizon. Tie the market to your personal fiefdom. If you have a solid plan with your advisor about what you want your portfolio to do for you personally you stay the course. That advisor will know when it is time to make tweaks to your portfolio – not because of market noise, but due to changes in potential achievement of your goals.

It is very easy to get caught up in the daily noise and let your emotions take over. A recently released report from the financial services consulting firm, Dalbar, indicated that attempts to time the market caused returns to significantly lag those of the market. Over the past 30 years the S&P 500 produced an average total return of 11.1% per year while investor’s equity returns averaged only 3.8% per year. What was the driver behind the poor performance? Market timing and emotions.

If you are a long term investor and have a meaningful plan to reach your goals, the daily headlines should not matter.

Chasing performance and trying to time the market is a futile exercise. Investors often exit the market after large selloffs or when it’s near the bottom. They dismiss the idea that it can rebound, and enter it when it’s near the top, with the conviction that it will continue to rise. They let their emotions take over. Investors should remember over the long term, the market, as represented by the S&P 500, has rewarded investors with an annual total return of just under 10% since 1928, but the only way to potentially realize those returns is to stay invested.

In the current environment, we remind ourselves of Warren Buffett’s phrase: “Be fearful when others are greedy, and greedy when others are fearful.” There is no crystal ball. No one can predict what the markets will do next, but we do know that they will rise and fall over time. The recent market volatility reminds us how difficult it can be to remain a disciplined investor. Maintaining perspective and focusing on your long-term goals and objectives is what matters most.

Although we fall victim to having a myopic view of our own world. It is important to pay attention to the entire world. Take leads, listen to someone else’s music, do something outside of your comfort zone to get out of your fiefdom. There is a whole world out there that might change your perspective of your own.