01 Sep Real Estate Reality

Real estate commonly is viewed as a barometer to the overall health and sentiment of the economy. Before the financial crisis and the housing bubble burst, there was a sense of euphoria: people believed home prices could “never go down” and real estate was a relatively “safe” investment. Although factors that led to the last housing bubble have diminished, concerns are beginning to rise that we could be heading in the same direction—and sooner than we think.

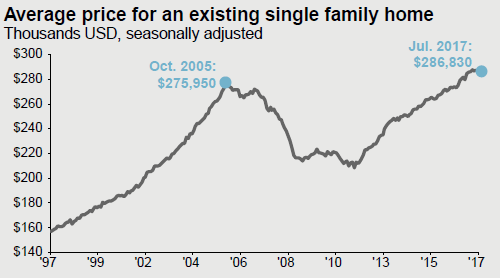

We are not opining whether we are or are not in a bubble, or that we’re even approaching one. We are simply providing the data and facts that many investors, economists, and pundits observe when evaluating the real estate market. The first graph below shows that the current average price for an existing family home eclipses the previous high in 2005. (The average price may not be indicative of your specific area; it is a national average). This equates to an approximate 4% increase over 11.5 years, or about 0.34% annualized. Considering inflation has been about 1.90% since 2005, this is well below the average, and typically would not indicate an overheating of the market. However, if you look at the annualized rate of prices since the bottom, a different picture emerges.

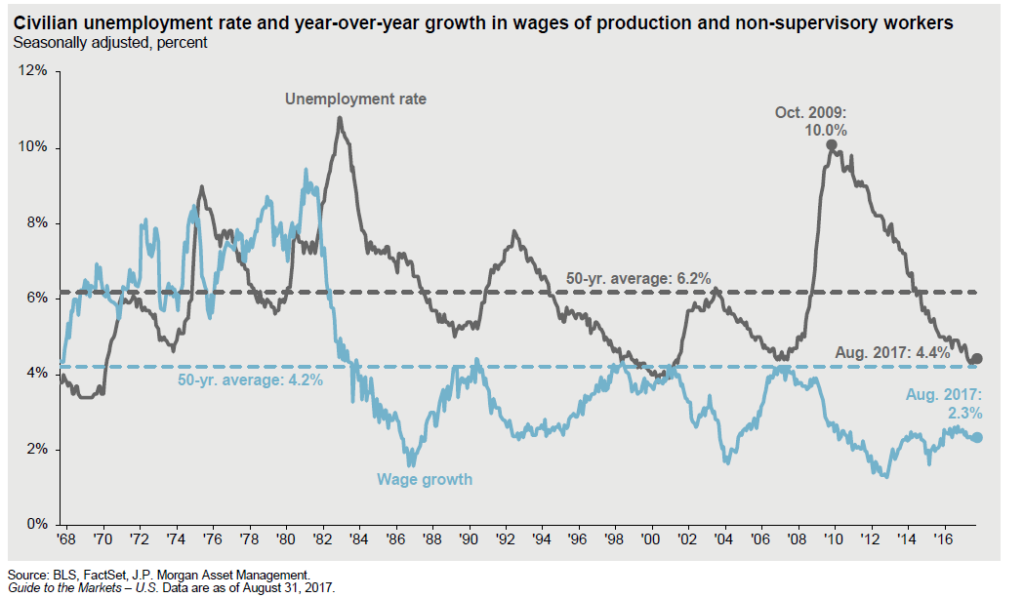

During the bottom of the market in October 2011, the average price of an existing family home was $209,000. This represents an approximate 5.7% annualized growth rate—more than double the pace of average hourly earnings, shown in the second chart below. This scenario makes us question how sustainable the current real estate market really is, or if prices have exceeded fundamental valuations.

So, what is driving housing prices? Well, there isn’t one simple answer. Unlike speculation (flipping), loose lending standards, and banking regulations we witnessed leading up to the last bubble, this time there are myriad reasons. First, the economy has improved. We no longer are in a recession, and personal finances have strengthened. Many millennials who have been living with roommates, or in their parents’ basements, finally have saved enough money to start looking for a place of their own, leading to a tremendous increase in housing demand. Unfortunately, there currently is a lack of supply and, as anyone who took Economics 101 knows, an increase in demand coupled with a lack of supply leads to price increases. These factors have primed home prices to move higher.

Additionally, mortgage interest rates are at historical lows: as of this writing, 30-year mortgage rates were 3.78%, the lowest since November 2016. Mortgage interest rates directly influence real estate prices. With low-cost borrowing, the borrower spends a smaller percentage of household income on their mortgage payment, resulting in a buyer being able to borrow more for a higher-priced home. According to the Housing Affordability Index by the Bureau of Economic Analysis (BEA) the affordability index today, at only 13%, is substantially better than the historical average of 19.4% of household income being spent on a mortgage payment.

Experts describe the current real estate market as a seller’s market, characterized by high prices and bargaining power biased toward the seller. But, with a few changes, the current market could easily switch to a buyer’s market. One major adjustment—higher interest rates—would have to materialize, and that may happen sooner than many people think. The Federal Reserve no longer is suppressing interest rates with quantitative easing, and has even indicated it would begin to unwind its balance sheet. In doing so, the Federal Reserve switches from being a net buyer to being a net seller of fixed income, which likely will pressure interest rates upward, forcing would-be buyers to spend a larger percentage of their income on mortgage payments. The end results are increased borrowing costs and decreased affordability. We believe an increase in interest rates is the biggest near-term threat to home prices—and that entirely depends upon the actions of Federal Reserve.

Increased supply could drive down prices, contributing to more of a buyer’s market. But until supply meets demand, and a new equilibrium is established, prices could stretch out of reach of many new buyers. Higher prices might force those buyers to move back in with roommates, or back to their parents’ basement, until prices come back down. The pendulum can swing—but only so far—before the market forces prices to correct. We see this ultimately as a potential long-term downward pressure on real estate, but believe that, near-term, demand will continue to outpace supply for as long as homebuilders experience difficulty finding skilled labor and buildable lots.

In our opinion, higher prices in the real estate market are warranted—but just how much higher prices can go is up for debate. The system has changed, for the better, since the last bubble: Average FICO scores for approved loans are at the highest level in decades; lending practices have strengthened; and banks are no longer leveraging their loan portfolios through hard-to-value derivatives. Yes, certain markets have outpaced wage growth and do not seem sustainable. But no matter what side of the real estate market you are on—buyer or seller—knowing what factors influence real estate prices will help you determine and uncover value, potentially saving you money in the long run.