01 Apr Taxman’s Coming

Benjamin Franklin once said, “There are only 2 certainties in life: death and taxes.” Taxes are unavoidable and affect many aspects of our lives. The influence of taxes stretches far beyond just our bank accounts. Taxes are essential for a country, government, and municipalities. These revenue streams support everyday operations and long term initiatives. Taxes influence a wide range of our decisions whether to buy or sell or influence how we vote and who we vote for. Income, property, capital gains, imports, and estate taxes; the list goes on. In its earliest form, taxation of some kind has been around since as far back as 98 B.C. Written in Greek on a piece of pottery, an Egyptian tax receipt shows a bill for more than 220 pounds of coins. The receipt stated that a person and his friends paid a land transfer tax that came to 75 talents, with a 15-talent charge added on. Fast forward a couple thousand years and taxation is now a universally accepted principle.

As Americans across the country file their taxes by the April 15th deadline, they either hope for a refund or curse how much additional tax they owe. With the recent increase in taxes due to the expiration of the Bush era tax cuts and elimination of previous deductions, some upper-income Americans feel their taxes are too high. The perception of taxes being too high could be attributable to the increasing discontent with the federal government, or new laws such as the Affordable Care Act. Whatever your political take on taxations might be, we wonder if there is a better system. Is there a tax system that works best for our country? This has been a highly debated question since the beginning of taxation. Although there is no universally accepted best way to tax, how much to tax, or who to tax what, we thought we would take a deeper look at various systems across the world and compare and contrast against our own. You may find the grass isn’t always greener.

United States

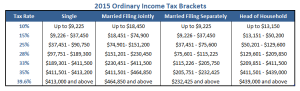

In the United States, our income tax structure is based on each individual’s level of income. In the simplest form, the more you make each year, the more you will have to pay in income taxes. This is known as a progressive tax system. Currently, the highest individual tax bracket is 39.6%. In addition, a 3.8% Medicare surtax is levied on the lesser of net investment income or the excess of modified adjusted gross income (MAGI) above $200,000 for individuals, $250,000 for couples filing jointly, and $125,000 for spouses filing separately. It is easy to understand why many people believe there has to be a better way.

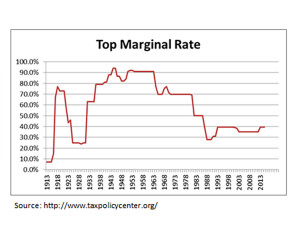

For those of you who think that sounds high, the United States once had a top income tax rate of over 90% (see chart) in the years after World War II. We are currently at the hightest tax levels sinc ePresident Reagan.

Global

Globally, the highest tax rate belongs to Aruba. Aruba has the highest income tax rate in the world, where the highest bracket of income is required to pay a 58.95% marginal tax rate. Like the United States, Aruba’s tax structure is progressive, but the top income bracket is any individual that makes over $171,149. This is much lower than the $400k+ in the United States. From a corporate tax rate perspective, Aruba is lower than the United States’ corporate tax rate at 28% compared to 35% at the highest income levels. Although many may scoff at the high tax rates, the citizens have one of the highest standards of living in the Caribbean region. On the other hand, the United Arab Emirates (UAE) does not impose a personal income tax.

Every country in the world has implemented their own system of taxation on its citizens and businesses. The U.S. is no different; we are still relatively tax-friendly with a marginal tax rate of around 28% on average income workers. American citizens have the highest income per hour worked of any nation surveyed. By any objective measure, the United States and its relatively low tax rates offer the best of both worlds — reasonable social safety nets, and extraordinary economic capacity stemming from essentially free market policies. It is impossible to determine which tax structure is the ultimate solution for every nation, but in reality taxes should not be viewed as a financial burden, but as an appropriate price to pay for a functioning society. No matter what side of the tax spectrum you might fall, your tax dollars are required for the survival of a nation’s government, and all of its programs, expenditures, and subsidies. Without taxation our great country would not be what it is today.